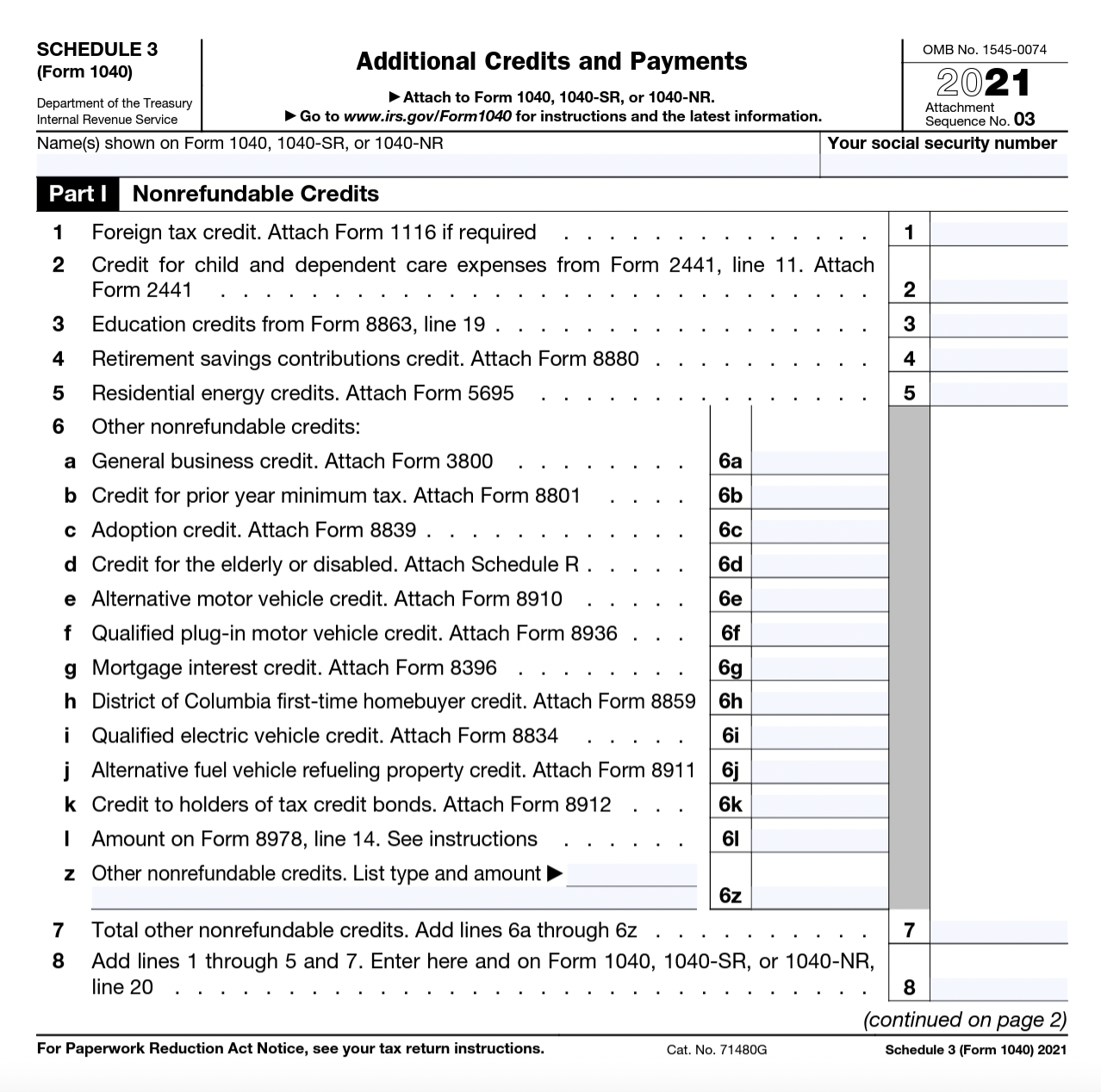

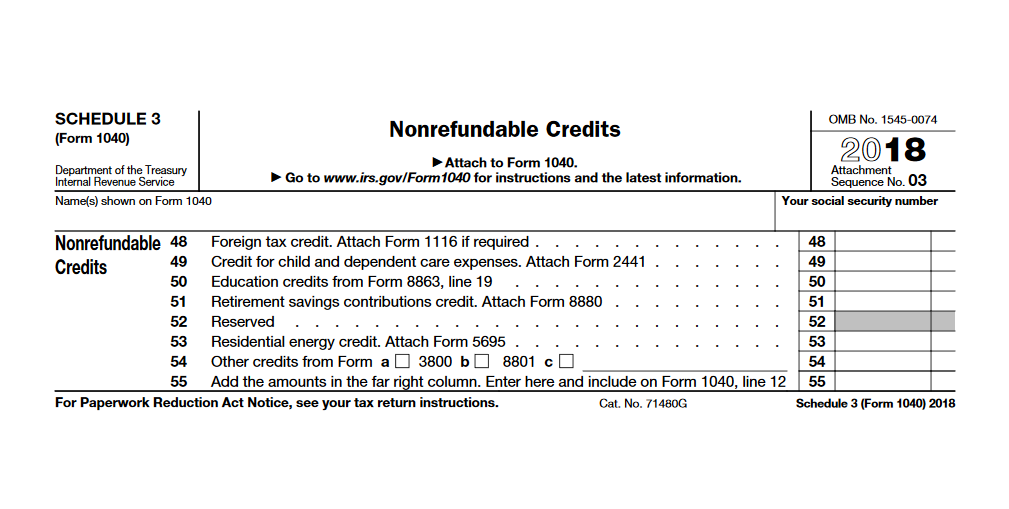

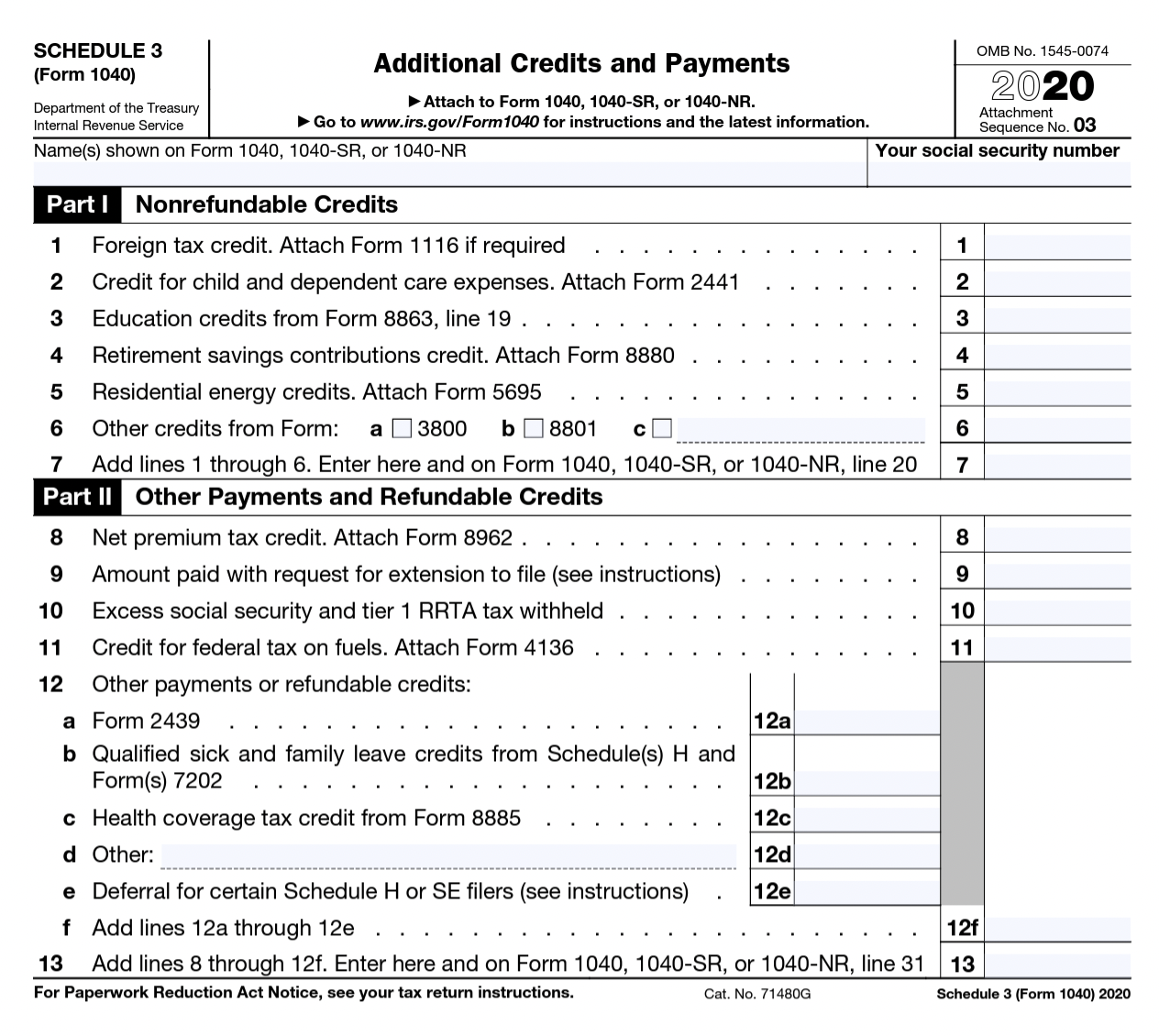

2024 Irs 1040 Schedule 3 Form – The IRS has adjusted federal income tax bracket ranges for the 2024 tax year to account for inflation. Here’s what you need to know. . Make sure you compare both methods and select the one that benefits you the most. Refer to Schedule 3 of Form 1040 for additional tax credits and complete it as applicable. 9. Calculate Taxes Owed or .

2024 Irs 1040 Schedule 3 Form

Source : tuition.asu.edu

What is IRS Form 1040 Schedule 3? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

IRS Schedule 3: Find 5 Big Tax Breaks Here

Source : finance.yahoo.com

Free tax filing tool coming to New York State

Source : www.rochesterfirst.com

IRS moves forward with free e filing system in pilot program to

Source : wgnradio.com

IRS moves forward with free e filing system in pilot program to

Source : www.everythinglubbock.com

SEEK Program | The City College of New York

Source : www.ccny.cuny.edu

Most commonly requested tax forms | Tuition | ASU

Source : tuition.asu.edu

IRS moves forward with free e filing system in pilot program to

Source : www.fox13memphis.com

2024 Irs 1040 Schedule 3 Form Most commonly requested tax forms | Tuition | ASU: For 2024, the maximum HSA contribution for somebody with self-only The HSA catch-up contribution limit for people age 55 and over is not inflation adjusted, so it remains at $1,000. 0% tax rate if . Although the date for filing your tax return for 2024 is a long way off, smart taxpayers will start thinking about that return far in advance. Proper tax planning takes time, so it’s actually wise to .